- Google finished the second quarter with $14.3 billion in ad revenue compared to Facebook’s $2.68 billion. Ad revenue accounts for more than 90% of both companies’ overall revenue.

- Facebook’s mobile ad revenue accounts for more than 60% of its overall ad revenue, while Google mobile ad revenue accounts for only 12% of the company’s overall revenue.

- In the second quarter, Google’s aggregate paid clicks grew 25%, more than offsetting the 6% decline in CPC.

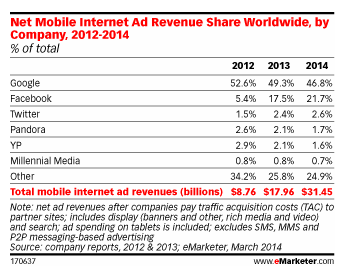

Facebook and Google are the two largest online ad companies in terms of ad revenue. Although Google's ad revenue still stands head and shoulders above Facebook's, the social media giant has been making impressive progress especially in the mobile space. Google finished the second quarter with $14.3 billion in ad revenue compared to Facebook's $2.68 billion. Ad revenue accounts for more than 90% of both companies' overall revenue.

Source: eMarketer

Facebook seems to have cracked mobile ads while Google continues to struggle. Facebook's mobile ad revenue accounts for more than 60% of its overall ad revenue, while Google mobile ad revenue accounts for only 12% of the company's overall revenue. Judging by how fast Facebook mobile ad revenue is catching up to Google's, it might only take 2-3 years before the social media company officially becomes the largest mobile ad company in the world.

Facebook mobile ad tools

Facebook has borrowed a few plays from Google, such as its self-service ad tool which is in effect a knock-off from Google AdWords. Facebook also introduced Mobile app-install ads in October 2012. App-installs is a tool that drives more traffic to Facebook ads and encourages users to download them. Since its introduction, app-installs has been a huge success with more than 350 million apps having been downloaded from Facebook pages to-date. Macquarie Equities Research provided conservative estimates that Facebook earns about $2-$3 for every app downloaded from its pages, adding that some companies pay $3-$4 per install. Given the healthy growth of app-installs, Facebook could realize 500 million app downloads in the current fiscal year, implying a revenue of $1 billion to $1.5 billion from app-installs. The tool is highly popular with app developers because it helps them save as much as 15% to 60% in traffic acquisition costs.

Additionally, Facebook has added more tools to drive traffic to mobile ads such as Listen Now, Shop Now, Play Game, Watch Video, Open Link and Use App.

Facebook announced a set of new mobile development tools during this year's f8 developer conference. Key among these was the ''cross-platform platform.'' Through this platform, Facebook is trying to position itself as the developer's friend by offering cross-platform development tools that cut across Android, iOS, and Windows devices. Facebook can lure mobile app developers into its own camp by helping them stick out and be discovered easily in today's competitive mobile app development landscape. Developers will still depend on iOS and Android to access the majority of handsets, while Facebook will help their apps to reach a wider audience and make more money. Additionally, Facebook will offer a mega SDK (software developer kit) to mobile app developers that will be built around app marketing services.

Google's key advantages

There is no denying that Google is facing a very formidable competitor in Facebook as far as monetizing ads, especially mobile ads, is concerned. Certain products, however, cannot easily translate across the two different platforms. For instance. Google dominates paid search while Facebook lacks a product that can compete directly with this.

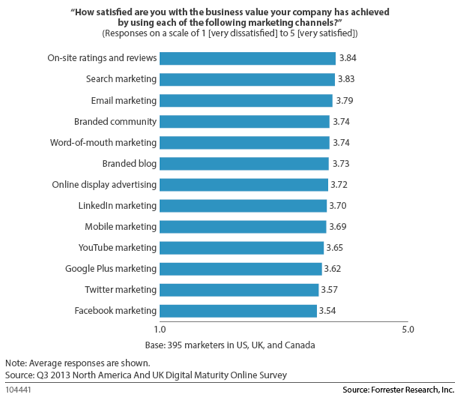

As things currently stand, the majority of marketers still prefer Google to Facebook as a digital marketing platform. Forrester Research conducted a survey last year to determine the most popular marketing platform for digital marketers. Most online marketers showed a strong preference for search marketing, which is Google's main forte, while Facebook marketing brought up the rear.

Interestingly, Nate Elliot, a Forrester Researcher, wrote an open letter to Facebook chief executive Mark Zuckerberg lambasting the company for failing marketers. According to Mr. Elliot, Facebook displays each brand post to only 16% of its users. To aggravate matters, fewer than 15% of Facebook ads leverage the social networking company's huge cache of social data to try and target the most relevant audiences. In other words, Facebook, despite spewing out billions daily of ads daily, was doing a poor job at targeting the kind of audiences that marketers wanted.

Source: Forrester.com

In all fairness, what Mr. Elliott was carping about is really not Facebook's fault. Facebook faces a dilemma when it comes to displaying ads to its users since it must perform a delicate balancing act. On one hand, Facebook wants to be viewed favorably by marketers since, after all, ad revenue is its bread and butter. On the other hand, Facebook risks making itself unpopular if users start viewing it as a place where they go to be served with hundreds of unsolicited ads. People do not go to Facebook looking for ads, and in fact many view them as an antisocial offering on the platform.

Google, however, enjoys a lot of free rein when it comes to ads. The search company displays ads to its users in direct response to certain keywords they use in their search queries. Google's ads are, therefore, viewed as more natural, and even helpful, by the majority of users since it provides them with more information about their searches. This reason alone makes Google more appealing to online marketers than Facebook, and explains why this is likely to remain this way.

Falling CPC is not an indication of poor monetization rates

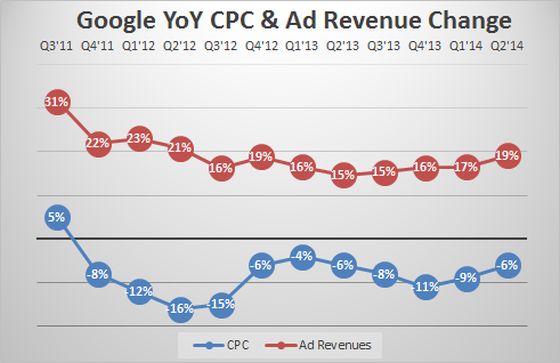

Many people who lament how Google is losing its grip on online ads point to its CPC (cost per click), which has fallen for 11 consecutive quarters.

Source: SearchEngineLand

The decline in CPC can be chalked up to two main causes:

- Role of emerging markets

Google has noted on more than one occasion that as more clicks come from emerging markets and lower-priced markets, the average CPC has been falling. Most of Google's growth is currently coming outside North America. In the second quarter of the current fiscal year, Google's CPC in EMEA (Europe Middle East and Africa) as well as APC (Asia /Pacific) was down by about 7%.

- Growth in Mobile Ads

Mobile CPC is typically lower than desktop CPC. As mobile ads increasingly make up a larger part of Google's revenue, the average CPC is bound to come down gradually. This trend is likely to continue until a time when the ratio of mobile ads to desktop ads finally stabilizes.

It's important to note that Google's overall click volume has been growing consistently even as its CPC has kept falling. In the second quarter, Google's aggregate paid clicks grew 25%, more than offsetting the 6% decline in CPC.

Bottom line

Although Facebook is quickly emerging as one of the most dominant players in the online ad market, there is no evidence yet that this is negatively impacting on Google's growth. The online ad market continues to grow at a healthy clip creating enough space for the two giants to co-exist without necessarily encroaching into each other's domain.

No comments:

Post a Comment